Chessbase, 2008

I'd intended to write a piece last weekend about a crochety old English chess master who gets into trouble when he doesn't think the rules apply to him. However, being, in truth, a little more sympathetic to Nigel over that particular issue than I normally am, we'll leave that aside for the moment. Instead, let's talk about Mike Basman.

Why so? Because the popular British IM has got himself into trouble. How so? Take your pick. It's either

- because over perhaps as long as twenty years, he couldn't be arsed to comply with his legal obligations with regards to tax; or

- because he is being persecuted by Her Majesty's Revenue and Customs

The exact details of the saga which have led to Basman's current predicament are not yet entirely clear, the reason for this being that Mike Basman has chosen not to make them entirely clear (which we will get on to, below). Nevertheless the basic outline seems straightforward enough - it appears that

- the UK Chess Challenge, the competition that Mike Basman has organised since it began in 1996, has failed to charge VAT on entry fees for its competitions, as it was legally obliged to do;

- this having come to HMRC's attention, they have presented Basman with a bill representing an estimate of the revenue lost to them over a ten year period, which is in the non-trivial amount of £300,000; and

- as Basman cannot pay this bill, he was made bankrupt on 8 August 2016, thus threatening the future of his competition (leaving aside alone any consequences for himself).

I have a view on this, which is that Mike Basman is a fool, a fantasist and a tax evader.

Caption competition waiting to happen

I said that we don't know the exact details of the saga - it's unclear to me, for instance, whether or not proper accounts were actually submitted for the UK Chess Challenge, how HMRC came to be aware of the fact and extent of Basman's negligence, and so on - but despite appealing for the help of the public in this petition, Basman's strategy has been bizarre, even by Mike Basman standards.

He, has for instance, issued a poster comparing his plight to that of Alan Turing

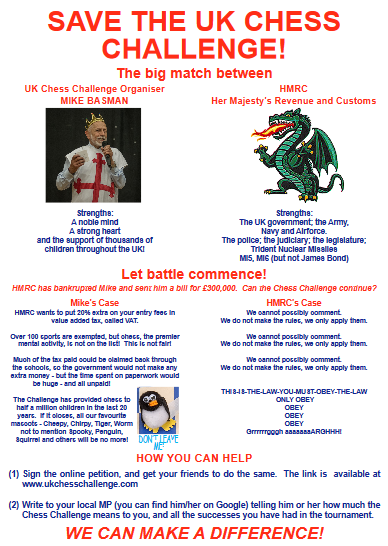

and another one portraying himself as St George battling the HMRC dragon

and perhaps best of all, a rambling statement comparing his legal obligations to the practice of slavery.

These are so ludicrous it's funny. Or perhaps so ludicrous that it really isn't funny.

Then there's his statement in a less-than-adequate article in the Telegraph that

There's no way I can pay this. I'm a chess teacher, and my work is to run a tournament, not to collect tax.Well, despite all the bluster, actually the work of a self-employed person does often involve collecting tax, and had he done so there would be no bill now to pay. Judging by most commentary on the subject, most people in the chess community seem to understand this and hence, whatever their views on the obligations of the self-employed, or the application of VAT to chess, people seem to view Mike Basman, with varying degrees of sympathy or otherwise, as the author of his own misfortune. Which of course he is.

There are always clowns, of course, who in this instance - perhaps misled by the tone of the Telegraph piece - think that he is "being bankrupted by a bunch of pencil sharpeners" or that he is being "persecuted", or that he "deserves a gold medal" or that all that has happened is that "he has a tax bill". (As opposed, John, to having reached the end of a legal process extending over a number of years and culminating in bankruptcy because he chose to avoid his obligations in law.)

None of these people, nor indeed Mike Basman himself, have any explanation as to how, even if the law were changed tomorrow, this would annul an existing six-figure tax bill. Nor why, if he objected to the obligations he was expected to undertake, he didn't undertake them anyway while seeking a change in the law. Nor why, if he really were a campaigner against an unjust imposition, this defiant stand hasn't been carried out openly and publicly all this time. (He's now comparing himself to Gandhi. Uh huh. Well that's as if Gandhi had spent years campaigning against the salt tax on the quiet, without anybody knowing.)

But of course nobody has any explanation, because these are all absurdities. This hasn't suddenly happened. It's not come out of the blue. Mike Basman had been seeking to get away with it for years and in the end the law - if not reality - caught up with him. The end. End of story, and quite likely the end of the UK Chess Challenge too. The fault for this lies entirely with Mike Basman.

I don't allege that Basman's motives were primarily financial. Quite likely his actions have been led by nothing more or less than enormous pigheadedness. To know Basman's reasons, I'd have to know a lot more than I do. But to think this was anybody else's fault but his, I'd have to know a lot less.

Last thing. When I first wrote about Howard Curtis on this blog, I referred to an Emergency General Meeting of Surrey County Chess Association which took place around the middle of the last decade, an unpleasant occasion when I had the opportunity to observe both that extremely unpleasant man and his acolytes.

Also at the meeting, opposing Curtis, was Mike Basman. Basman took the opportunity to threaten Association officials with legal proceedings because, he claimed, they were supporting Curtis and his cult-like organisation against Basman, in a dispute over junior chess. (They weren't, as it happens.)

Now Mike Basman hasn't got a lot in common with Howard Curtis, unless it be a habit of sending barmy, aggessive emails making idle legal threats against people they think have crossed them (I've been on the receiving end from both). I don't like Basman, but he's not dangerous to be around. He doesn't belong in prison

But there we were, a huge dispute going on in Surrey junior chess, between two factions, one the followers of Howard Curtis, one the supporters of Mike Basman.

And as it turns out, one was an abuser of children and women while the other was a long-term tax evader.

Isn't that just great?

Image

The eventual outcome of the row was that CCF set up a UK Chess Challenge look alike. It may even have been the cause of the row. It appears to be still running to this day.

ReplyDeletehttp://www.englishchesschallenge.co.uk/2016.htm

I don't think it ever expanded outside CCF's catchment area of Surrey, Kent and Sussex. Given the range of its activities, I'd imagine CCF is one of the few chess organisations whose turnover might approach the VAT exemption limit.

RdC

Fabulous to know that the alternative to the tax evader is still the religious cult with a history of abuse.

ReplyDeleteCCF is officially structured as a not-for-profit. I don't know how that impacts its VAT status.

ReplyDeleteI am sure that I speak for the majority of UK chess-players in:

ReplyDeletea) applauding the success of UKCC;

b) desiring increased public recognition (and funding) for Chess;

c) finding the disadvantageous VAT status of Chess vrs physical sports a little hard to swallow.

So why is the support for Michael Basman from the UK chess fraternity more that a little muted? Unfortunately Michael has weakened his case by mashing up some reasonably decent points with some frankly ridiculous arguments.

Yes, VAT collection and administration is a pain for the small business. But no, that doesn't mean its a form of slavery. Slavery is an involuntary institution. But if one finds VAT administration onerous, one could either cease trading altogether, or (better still) employ a book-keeper and pass the cost onto the customer.

Yes, the net VAT loss to HMRC is probably somewhat less that the £300k demand falling on UKCC, given the possibility of VAT reclaim by UKCC and its main customers (schools). Of course, we'll never know, until Michael goes public on the UKCC accounts. But no, that doesn't mean a company or sole trader can simply decide (off its own bat) to ignore VAT regulations. Tax collection just doesn't work in this way, stupid.

If Michael had really, deeply cared about securing the future of UKCC, he would have taken the trouble to set up UKCC on a sound legal and administrative basis. Of course that means conforming to VAT regulations and utilizing an accountant to oversee the considerably moneys passing through the hands of UKCC.

Rather than mounting an effective defence of UKCC, Michael has only weakened the case for public funding for Chess. If a life-time dedicated to Chess leads only to serial tax-evasion, with nothing more than this deluded, self-justificatory drivel to offer in its defence, then what need of public support for Chess?

Anyone out there who still thinks that proficiency in Chess automatically makes one smarter, wiser or more self-aware? Read this and weep!

Mike Basman may well be a flawed individual with a tax liability but as he is a declared bankrupt HMRC will have to accept a token payment to settle the affair.

ReplyDeleteQuite simply, as a bankrupt he does not have the money or the obligation to make a full repayment of the money owed.

Yes, he is guilty of failing to charge VAT as he should have, but this was hardly tax evasion for personal gain.

He is not exactly Sir Fred Godwin or SirPhilip Green, is he?

He should be judged on the impact he has had in the chess world over decades, not castigated for financial incompetence?

Well firstly, it's not incompetence he's being castigated for, but cheating.

ReplyDeleteSecondly, if he doesn't want to be castigated he shoukdn't be posing as a martyr.

Thirdly, we don't actually know that no personal gain was involved, and I see no reason to make that assumption. I do note though that the new owners say they will be charging VAT without actually charging more for entry.

The uk chess challenge is still running today in 2021!!! OHHHHHH!!! Michael Basman is an amazing person.

ReplyDelete